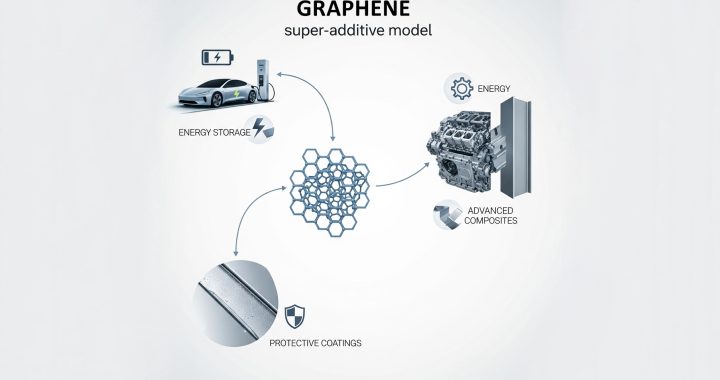

Graphene is at a critical inflection point, moving from a material of immense scientific promise to a viable commercial reality. The market is demonstrating a rapid growth trajectory, driven not by a single “killer application” but by graphene’s versatility as a performance-enhancing “super-additive.” This transition is being enabled by a recent wave of innovative, cost-effective, and scalable manufacturing methods that directly address the historical barriers of high cost and limited production volume. While a lack of standardized market definitions leads to significant data variability, all forecasts consistently point to robust, double-digit growth.

The energy storage sector, particularly for electric vehicles and grid-scale solutions, represents the most active frontier, where graphene’s unique properties are enhancing existing battery and supercapacitor technologies. Furthermore, its adoption as an additive in advanced composites and coatings is a dominant commercial model, providing a low-friction pathway into multiple industrial sectors. The latest breakthroughs in production, such as Flash Joule Heating and novel dry exfoliation processes, are the most significant developments, as they fundamentally alter the economic landscape of graphene, making it a viable commodity for mass-market applications. This strategic shift from a high-tech material to a scalable, low-cost additive is poised to accelerate its integration into the global supply chain.

The Evolving Graphene Market: From Lab to Commercial Reality

Market Size and Growth Projections: Reconciling the Data

The global graphene market presents a paradoxical profile, characterized by both high growth potential and significant data inconsistency. Multiple market analyses consistently forecast an aggressive expansion over the next decade. For example, Straits Research projects a Compound Annual Growth Rate (CAGR) of 30.2% from 2025 to 2033, with the market size soaring from USD 698.93 million to USD 5771.94 million. Precedence Research echoes this optimism, anticipating a CAGR of 31.70% from 2025 to 2034, with the market growing from USD 598.29 million to USD 6,979.95 million. Another study from BCC Research forecasts a robust CAGR of 27.5% from 2025 to 2030, projecting a rise from USD 694.4 million to USD 2.3 billion.

Despite this consensus on growth, the baseline market size figures for the same years show a wide range of values. For instance, the market was valued at USD 536.81 million in 2024 by Straits Research , while Precedence Research placed it at USD 445.82 million. A different report estimated an average global revenue of USD 380 million in 2022 and a size of USD 1.08 billion in 2023. This variability is not a sign of unreliable research but is a direct reflection of the market’s immaturity and lack of standardized definitions. A Graphene Flagship report confirms this, noting that the massive spread in revenue values and growth rates can be attributed to “deviating definitions of graphene markets (such as inclusion or exclusion of secondary products)” by different report providers. In essence, the market is still defining itself, with some firms measuring raw material sales while others include the value of end-use products, leading to a fragmented and non-uniform picture.

The following table provides a consolidated view of these varied projections, highlighting the high-growth forecasts alongside the spread in baseline valuations.

Table 1: Global Graphene Market Projections (2022-2034)

Key Market Drivers and Strategic Trends

The market is being propelled by a confluence of technological advancements and overarching global trends. The increasing demand for high-performance materials in the energy and automotive sectors is a primary catalyst. Graphene’s exceptional electrical and thermal conductivity, combined with its immense surface area and strength, make it an ideal candidate for revolutionizing energy storage technologies. It can significantly improve the performance of lithium-ion batteries and supercapacitors by enabling faster charging, greater energy density, and longer cycle life. This aligns perfectly with the global push for clean energy and the widespread adoption of electric vehicles, where efficient and sustainable energy solutions are paramount.

Dominant Market Segments and Geographical Landscape

The current market is dominated by a few key segments, while others show promise for future growth. In 2023, the electronics components and automotive end-use segments held the largest revenue shares. Graphene oxide was the leading product type, accounting for a 47.0% revenue share, while graphene nanoplatelets also led in market share, with demand rising in diverse sectors such as electronics, aerospace, and defense. The composite applications, which involve using graphene as an additive in materials like plastics and resins, are expected to register the fastest CAGR in the near future.

From a geographical perspective, the market’s dynamics reveal a classic pattern for the commercialization of a new technology. North America currently holds the largest revenue share, accounting for 46% of the global market in 2024. However, Asia-Pacific is identified as the fastest-growing market, driven by its expansive manufacturing base and increasing production volumes in sectors like automotive, marine, and aerospace. This distribution suggests that the initial R&D and intellectual property generation are largely centered in North America and Europe , while the industrial-scale manufacturing and rapid adoption into mass-market products are now accelerating in Asia. This shift indicates a transition of the market’s center of gravity from an R&D-centric model to a mass-production model, with different regions leading different phases of the material’s maturity.

Commercialized Applications: A Sector-by-Sector Review

Energy Storage Solutions: The Most Active Frontier

Graphene’s exceptional properties are making a significant impact on energy storage, a sector with immense market pull.

Graphene-Enhanced Batteries

Graphene is not merely a theoretical solution for battery technology; it is an active enhancement in commercial products. Due to its superior electrical conductivity, graphene can improve the performance of lithium-ion batteries by enabling faster charging times, with potential to reduce charging from hours to minutes. This also leads to a longer useful life for batteries, with some reports suggesting an increase in lifespan by a factor of 10. Graphene’s excellent thermal conductivity is also a critical advantage, as it helps dissipate heat, preventing overheating and reducing the risk of thermal runaway, thereby enhancing battery safety and longevity. A tangible example of this commercialization is Graphene Manufacturing Group’s (GMG) SUPER G®, a graphene slurry designed to enhance the efficiency, power, and longevity of lithium-ion batteries.

The Rise of Graphene-Based Supercapacitors

Supercapacitors are a promising complementary technology to batteries, and graphene is proving to be a game-changer in this field. As fast, powerful energy storage devices, supercapacitors complement the slow charging and discharging of batteries by rapidly capturing and releasing energy. Graphene’s high electrical conductivity and large surface area are ideal for increasing the energy density of these devices. The market for graphene-based supercapacitors is projected to grow at a CAGR of 22.5% from 2025 to 2032, driven by the increasing demand for high-performance energy storage solutions in sectors like electric vehicles and consumer electronics, where rapid charging is a key requirement. A critical factor in this commercialization is the focus on scalability, with ongoing research aiming to make these devices ready for large-scale industrial production, not just laboratory-level performance.

Advanced Composites and Coatings: The “Super-Additive” Model

Graphene’s most prevalent and established commercial model is its use as a performance-enhancing additive. The strategy of integrating graphene into existing materials, rather than creating entirely new products, addresses a significant market barrier: the cost and complexity of overhauling manufacturing processes. By adding graphene to plastics, polymers, and construction materials, companies can impart incremental but meaningful improvements in mechanical performance, strength, durability, and resistance to corrosion, dampness, and fire.

Table 2: Key Graphene Companies and Commercial Products

Electronics, Sensors, and Beyond

While energy storage and composites represent the most mature commercial applications, other sectors like electronics, sensors, and health are still in earlier stages of development. Graphene’s exceptional conductivity and flexibility hold immense promise for next-generation flexible displays, wearable tech, and biosensors. High-sensitivity Hall sensors, which are twice as effective as existing silicon-based sensors, have already been reported. However, the research explicitly notes that applications in health and medicine, such as the use of graphene oxide for disease diagnosis or for developing artificial bones, are still primarily “in the research phase”.

This slower commercialization is not a sign of the technology’s failure but a direct consequence of the stringent material requirements for these applications. Unlike bulk composites that can use lower-purity, more scalable graphene, high-end electronics and biomedical devices require “top-tier,” defect-free, single-layer graphene. This high-quality material is significantly more expensive to produce, with prices reaching over USD 10,000 per kilogram for Chemical Vapor Deposition (CVD) graphene, compared to USD 100 to USD 1,000 per kilogram for commercial-grade graphene used in sensors and composites. The commercialization journey for graphene therefore follows a clear hierarchy: the most forgiving applications with the lowest cost-of-entry are paving the way, with more demanding, higher-value sectors awaiting breakthroughs that will reduce production costs and improve consistency.

Overcoming Commercialization Barriers: The Production Breakthroughs

The Historical Challenge of Scale and Cost

For years, the primary obstacle to graphene’s widespread adoption was the inability to produce high-quality material at a low cost and large scale. Traditional methods, such as mechanical exfoliation, yield high-quality, single-layer graphene but are not scalable. Conversely, methods like liquid-phase exfoliation are more scalable but often result in graphene with defects and multiple layers, compromising its superior properties. Chemical Vapor Deposition (CVD) produces high-quality material but is expensive, energy-intensive, and complex, making it impractical for mass-market applications. This historical trade-off between quality, cost, and scalability created a commercial “valley of death” that limited graphene to niche, high-value markets.

Innovative Manufacturing Processes: The New Engine of Growth

The most impactful recent research in the graphene space has been focused on new production methods that break this historical trade-off, enabling the material’s transition to a commercial commodity.

Flash Joule Heating (FJH)

A groundbreaking method developed by Dr. James Tour’s lab at Rice University, Flash Joule Heating (FJH), uses a powerful electrical pulse to convert various carbon sources into high-quality graphene flakes in milliseconds. The process is incredibly efficient, raising temperatures to over 3000 K (about 5,000°F) in a fraction of a second. What makes this a truly transformative breakthrough is its feedstock flexibility and cost-effectiveness. FJH can convert low-cost or even “negative-value” waste, such as food waste, plastic, and coal, into valuable graphene without the need for solvents, catalysts, or inert gases. This method fundamentally alters the business case for graphene, making it a sustainable, low-cost material for large-scale applications, including a potential substitute for sand in concrete.

New Dry Manufacturing Processes

Another significant advancement is NanoXplore’s new dry manufacturing process. This technology leverages advanced exfoliation to produce high-quality graphene from low-grade waste graphite, a byproduct of the graphite anode production process. The process reduces capital expenditures by nearly 50% compared to traditional liquid exfoliation methods, requiring a fraction of the physical footprint. This innovation allows the cost of graphene to reach “cost parity with traditional carbon additives such as carbon black,” a statement that represents a major milestone in commercial viability. The dry process is highly scalable, operates continuously, and eliminates the need for expensive and environmentally taxing washing and drying steps, making it an exceptionally efficient and sustainable route to mass production.

These recent manufacturing breakthroughs are the most critical element driving graphene’s market acceleration. They effectively resolve the long-standing challenges of cost, scale, and environmental impact that limited the material’s potential, paving the way for its integration into mass-market applications across multiple industries.

Table 3: Comparison of Graphene Production Methods

Future Outlook and Strategic Implications

The Path to Mass-Market Adoption

While the recent production breakthroughs have opened the door to widespread commercialization, the full diffusion of graphene will still take time. Despite the technical ability to produce high volumes, manufacturers still face the challenge of building a robust customer base and securing the necessary funding to scale up their production facilities. The report by German researchers in 2D Materials correctly notes that graphene “cannot immediately convert all its initial promises to overwhelming market success” and that its widespread adoption is a process that will take time. The market is now shifting from a focus on novel properties to a focus on supply chain reliability and standardization.

Recommendations for Stakeholders

The future of the graphene market will not be won on the promise of its properties alone, but on the ability of producers to deliver a consistent, high-quality, and cost-competitive product at industrial scale. The new battleground is supply chain infrastructure. Strategic investments should therefore be directed toward companies and initiatives that are addressing the following:

- Standardization: The development of widely accepted standards for graphene production and characterization is crucial. This will build confidence among manufacturers and investors by ensuring that a product labeled “graphene” from one supplier has the same properties and performance as a product from another.

- Infrastructure for Scale: Investment should target the companies that are not just researching new methods but are actively building the large-scale production plants to support industrial demand. The focus should be on technologies like FJH and dry exfoliation that can leverage low-cost feedstocks and require less capital investment.

- Additive-First Strategy: The most successful commercialization model to date has been the “super-additive” approach. This strategy of integrating graphene into existing materials is a low-friction entry point that bypasses the complexities of creating entirely new products and can accelerate market penetration.

In conclusion, graphene is at the cusp of fulfilling its long-held promise. The technical barriers to its commercialization have largely been surmounted, and the material is now positioned to become an essential component in the global clean energy transition. The next phase of its journey will be defined by the industry’s ability to build a reliable, standardized, and cost-effective supply chain to meet the burgeoning demand.